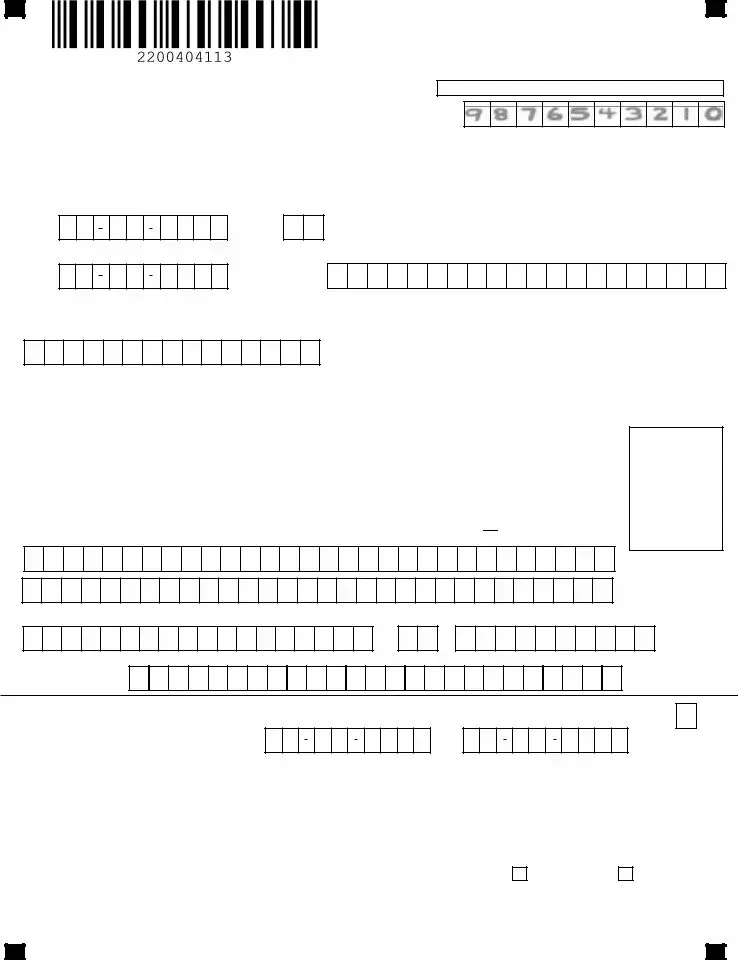

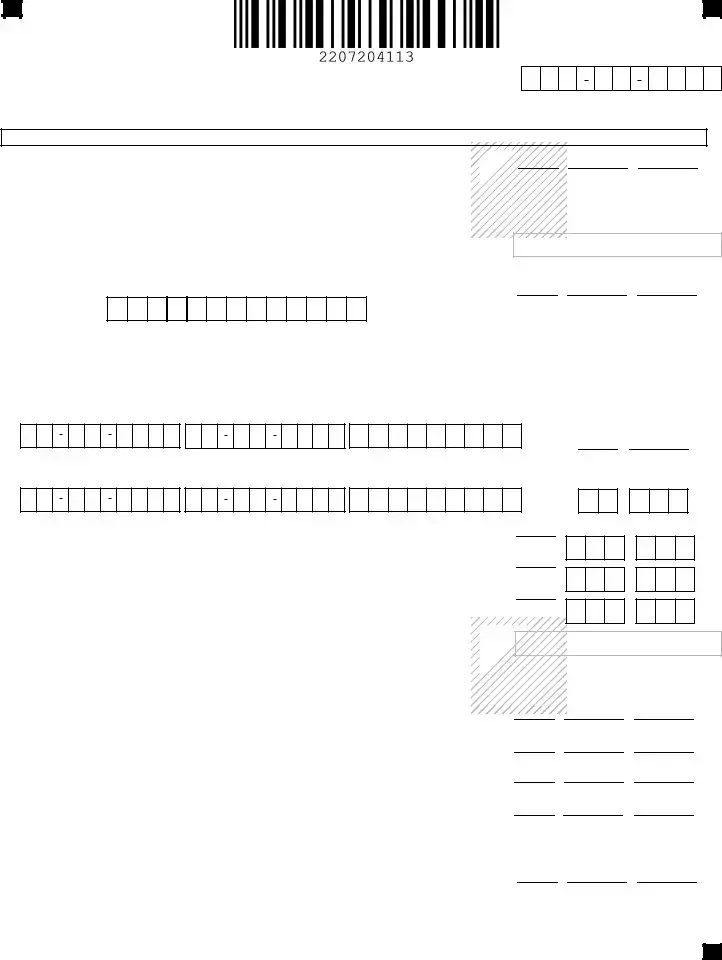

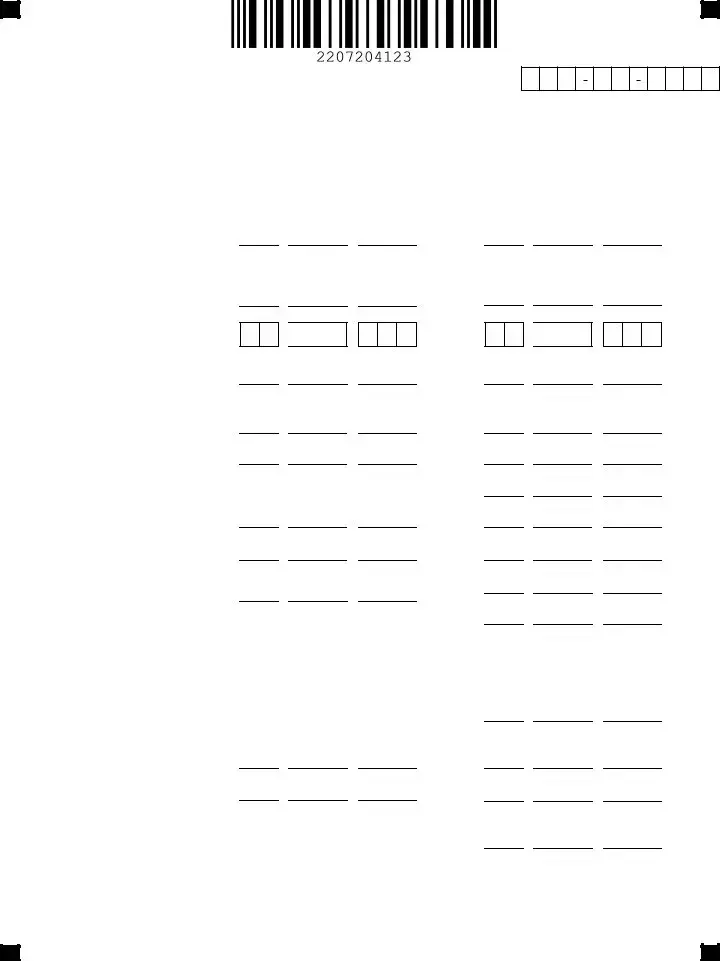

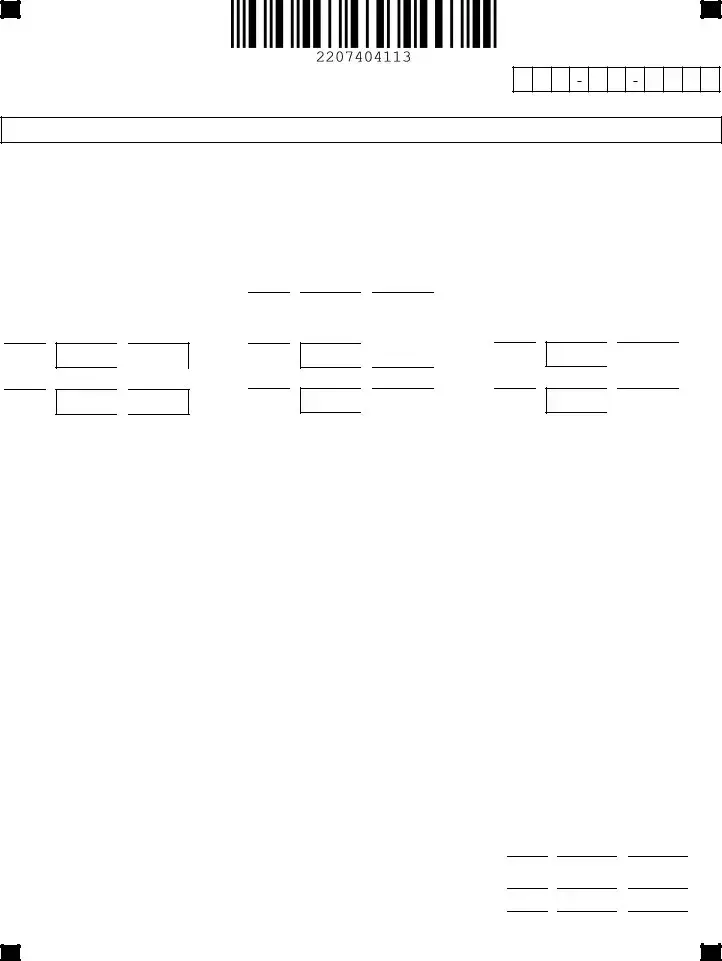

Fill a Valid Georgia 500 Template

The Georgia Form 500 is the official Individual Income Tax Return used by residents of Georgia to report their annual income and calculate their tax liability. This form is essential for ensuring compliance with state tax laws and is required for processing your tax return. Understanding how to accurately complete the Georgia Form 500 can help you avoid potential issues and maximize your tax benefits.

Get Form Here

Fill a Valid Georgia 500 Template

Get Form Here

Get Form Here

or

Download Georgia 500

Finish your form in minutes

Finish Georgia 500 online — fast edits, instant download.

,

,

.

.

,

,

.

.

,

,

.

.

,

, .

.

,

,

,

,

.

.

,

, ,

, .

. ,

,

,

,

.

.

,

, ,

, .

.

,

,

,

,

.

.

,

, ,

, .

. ,

, ,

,

.

.

,

,

,

, .

. ,

,

,

,

,

,

,

, .

. ,

, ,

,

.

.

,

,

,

, .

.

,

, ,

,

.

.

,

, ,

,

.

.

,

, ,

, .

.

,

,

,

,

.

.

,

, .

.

,

,

.

.

,

, .

.

,

,

.

.

,

, .

.

,

,

.

.

,

, .

. ,

, ,

, .

.

,

, ,

, .

.

,

, ,

, .00

.00 ,

,

,

,

.00

.00

,

, ,

,

.00

.00 ,

, ,

,

.00

.00  ,

, ,

, .00

.00

,

,

.00

.00

,

,

,

,

,

,

,

,

,

, .

.

,

,

,

,

.

.

,

, ,

, .

.

,

,

,

,

.

.

,

, ,

,

.

. ,

,

,

, .00

.00  ,

,

,

, .00

.00

,

,

,

, .

. ,

, ,

, .

.

,

,

,

, .

.

4

4

,

, ,

, .

.

,

, ,

,

.

.

,

,

,

,

.

.

,

, ,

,

.

.

,

,

,

, .

.

,

, ,

,

.

.

,

, ,

, .

.

,

,

,

,

.

. ,

, ,

, .

. ,

,

,

,

.

.

,

,

,

,

.

. ,

,

,

,

.

. ,

,

,

, .

.

,

, ,

, .

. ,

,

,

,

.

.

,

, ,

, .

.

4

4

,

,

,

, .

.

,

,

,

,

.

.

,

, ,

, .

.

,

,

,

,

.

.

,

, ,

, .

.

,

,

,

,

.

.

,

, ,

, .

.

,

,

,

,

.

. ,

, ,

, .

.

,

, ,

,

.

.

,

, ,

, .

. ,

,

,

,

.

.

,

,

,

, .

.

,

,

,

,

,

,

,

,

,

,

,

,

.

.

,

,

,

, .

. ,

,

,

,

.

.

,

,

,

,

,

, .

. ,

,

,

,

.

.

,

,

,

, .

. ,

, ,

, .

.

,

,

,

, .

.

,

,

,

,

.

.

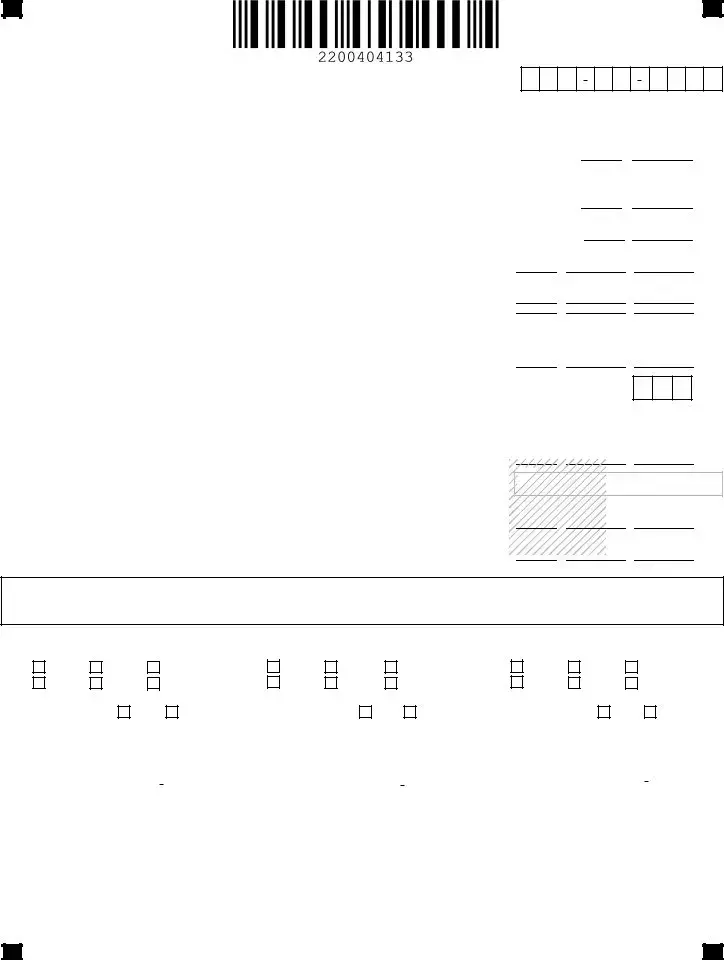

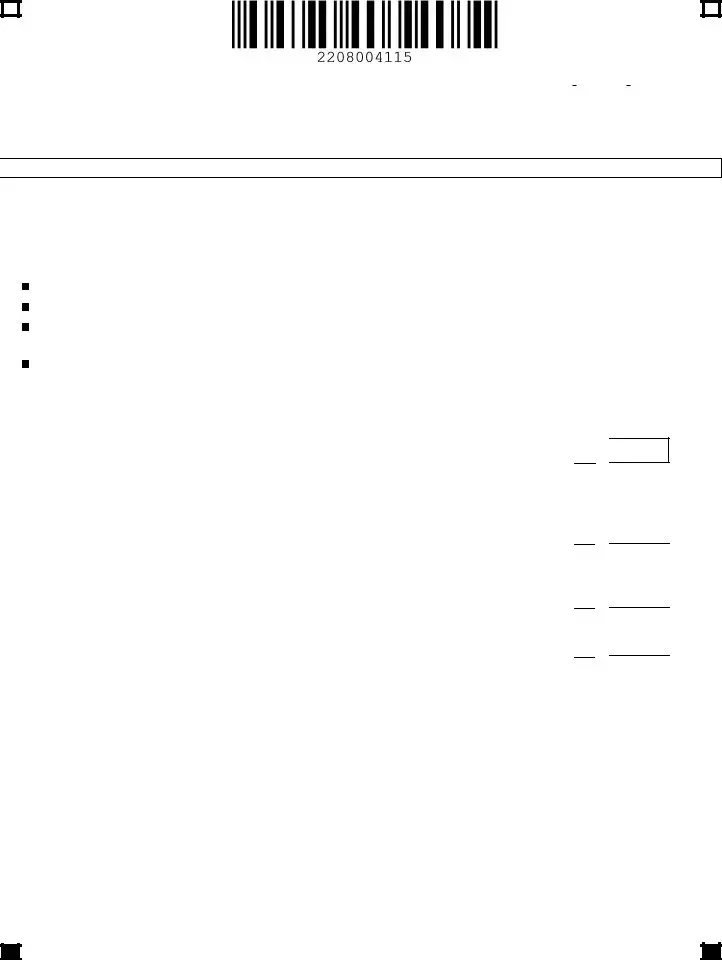

SCHEDULE 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201

SCHEDULE 201 Disabled Person Home Purchase or Retrofit Credit - Tax Credit 201

,

,

,

,

,

, .

.

,

,

.

.

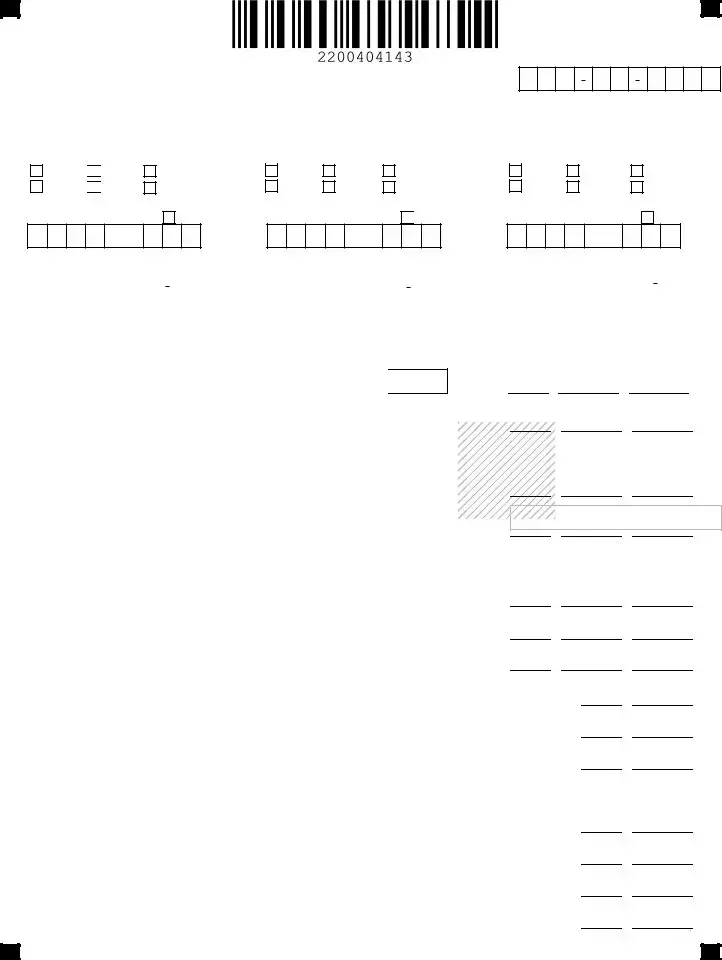

SCHEDULE 202 Child and Dependent Care Expense Credit - Tax Credit 202

SCHEDULE 202 Child and Dependent Care Expense Credit - Tax Credit 202

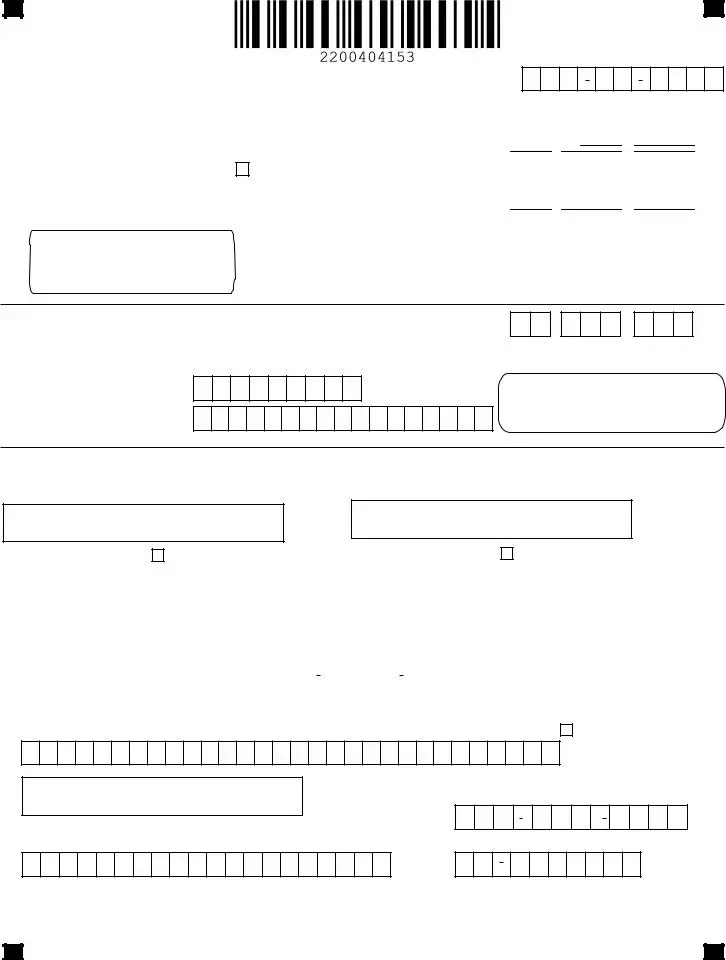

,

,

.

.

,

, .

.