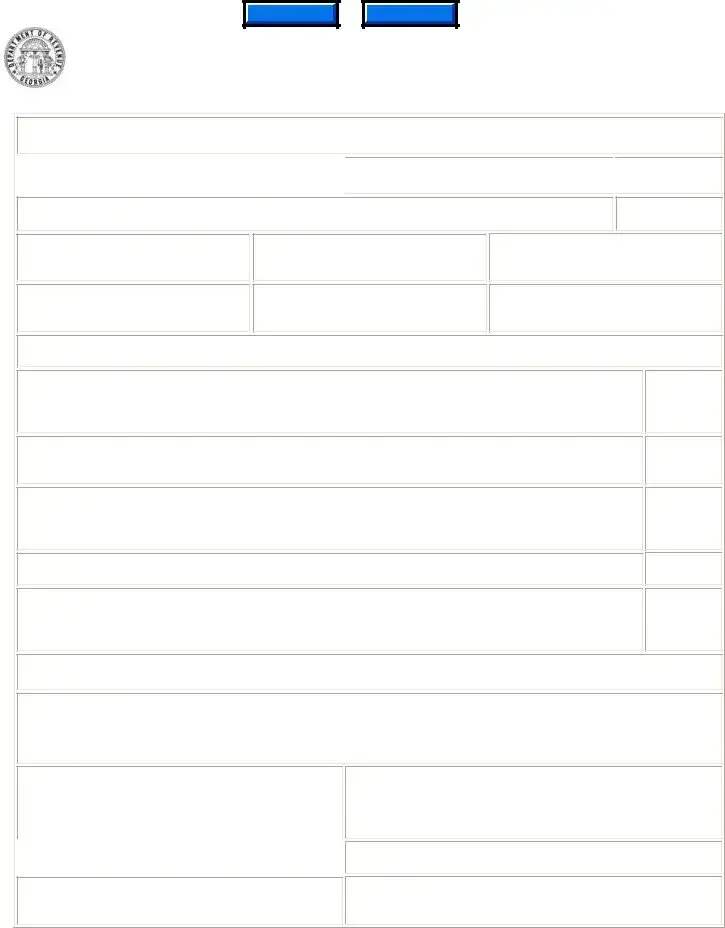

MV-66 (Rev. 3-2013)

Georgia Dealer’s Affidavit for Relief of

State and Local Title Ad Valorem Tax Fees

Full Legal Name of Georgia Dealer

Currently registered and in good standing with no tax liabilities?

Must answer yes and attach copy of Georgia Dealer, Distributor or Manufacturer Registration card.

Zip Code

Zip Code

□ Yes □ No

Vehicle Identification Number:

Check “Yes” for the appropriate statement which describes the relief for which you are applying and swear or affirm

such vehicle is or will be immediately placed in inventory and offered for sale.

O.C.G.A. 48-5C-1(d) (15) (A) & (G). Dealer is acquiring or foreclosing a security interest or lien pursuant to the Uniform Commercial Code in accordance with Part 6 of Article 9 of Title 11?

Attach copy of assignment of installment loan agreement, note guaranty, security, or affidavit of foreclosure of a security interest.

O.C.G.A. 48-5C-1(d) (15) (B). Certificate of Title application supported with a surety bond?

Attach vehicle title history from state holding title records and affidavit of all efforts to acquire marketable Certificate of Title form MV-46A; must have release of any recorded security interests or liens.

O.C.G.A. 48-5C-1(d) (15) (C). Dealer holds or has acquired a mechanics lien pursuant to O.C.G.A. 40-3-54?

Attach certified Copy of Court Order, certificate of vehicle inspection by law enforcement form T-22B, original tear sheet of newspaper advertisement and statement of no bidders entering a bid over lien amount.

O.C.G.A. 48-5C-1(d) (15) (E). Dealer must acquire title to obtain a total loss claim payment. Attach copy of police report of stolen vehicle and insurance report.

O.C.G.A. 48-5C-1(d) (15) (F). Dealer holds a marketable interest in a motor vehicle which will be offered for sale or has been sold without a marketable Certificate of Title.

Attach an Affidavit of Correction of a Georgia Certificate of Title form MV-18, Odometer Discrepancy Affidavit form T-107 or any supporting documentation, if applicable.

Oath and Affirmation

The undersigned hereby swears and affirms under oath that the information contained herein is true and correct.

Pursuant to O.C.G.A. 40-3-1, et. siq. & 16-10-7 (a) A person to whom a lawful oath or affirmation has been administered or who executes a document knowing that it purports to be an acknowledgment of a lawful oath or affirmation commits the offense of false swearing when, in any matter or thing other than a judicial proceeding, he knowingly and willfully makes a false statement.

(b)A person convicted of the offense of false swearing shall be punished by a fine of not more than $1,000.00 or by imprisonment for not less than one nor more than five years, or both.

Sworn to and subscribed before me this __________ of

|

(Day) |

_____________________________, |

____________ |

(Month) |

(Year) |

|

|

Notary Public’s Printed Name: |

|

|

|

Notary Public’s Signature & Notary Seal or Stamp Date Notary Commission Expires:

Printed Name of Sole Proprietor/Partner or Executive Officer:

Signature

County Tag Agent Accepting Affidavit

This form must be legibly completed and attached to application for the Certificate of Title.

Any alteration or correction voids this form. County Tag Agent shall retain a copy for audit purposes.

Zip Code

Zip Code