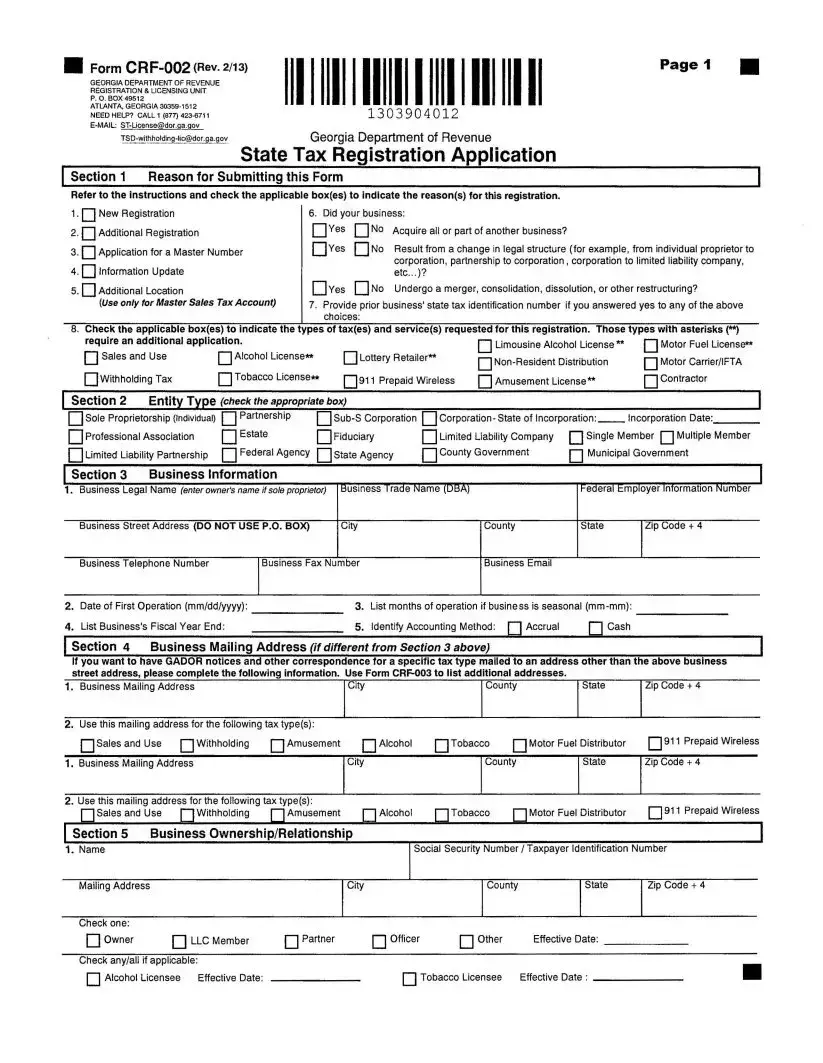

■ Form CRF-002 (Rev. 2/13) |

1303904012 |

Page 1 |

GEORGIA DEPARTMENT OF REVENUE REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA 30359-1512 NEED HELP? CALL 1 (877) 423-6711

E-MAIL: ST-License@dor.Qa.QQv

TSD-withholding-lic@dor.ga.gov

ОЛППЛЛЛ1 n

l3039040l2

Georgia Department of Revenue

State Tax Registration Application

Section 1 Reason for Submitting this Form

Refer to the instructions and check the applicable box(es) to indicate the reason(s) for this registration.

1 • New Registration

2.Additional Registration

3.Application for a Master Number

4.Information Update

5.Additional Location

(Use only for Master Sales Tax Account)

6. Did your business:

Yes |

No |

Acquire all or part of another business? |

Yes |

No |

Result from a change in legal structure (for example, from individual proprietor to |

|

|

corporation, partnership to corporation, corporation to limited liability company, |

|

|

etc...)? |

Yes |

No |

Undergo a merger, consolidation, dissolution, or other restructuring? |

7.Provide prior business' state tax identification number if you answered yes to any of the above choices:

8. Check the applicable box(es) to indicate the types of tax(es) and service(s) requested for this registration. Those types with asterisks (**)

|

require an additional application. |

|

|

Limousine Alcohol License** |

Motor Fuel License** |

|

| | Sales and Use |

| |

| Alcohol License** |

Lottery Retailer** |

|

Non-Resident Distribution |

Motor Carrier/IFTA |

|

|

|

|

|

|

|

|

Withholding Tax |

□Tobacco License** |

911 Prepaid Wireless |

Amusement License** |

| | Contractor |

|

| Section 2 |

Entity Type (check the appropriate box) |

|

|

|

] |

|

Sole Proprietorship (Individual) |

| |

| Partnership |

Sub-S Corporation | |

| Corporation - State of Incorporation: |

Incorporation Date:. |

|

Professional Association |

| |

| Estate |

Fiduciary |

Limited Liability Company |

Single Member | | Multiple Member |

|

Limited Liability Partnership |

|

Federal Agency |

State Agency |

County Government |

[ | Municipal Government |

|

|

|

|

|

|

|

|

| Section 3 |

Business Information |

|

|

|

j |

1. |

Business Legal Name (enter owner's name if sole proprietor) |

Business Trade Name (DBA) |

Federal Employer Information Number |

|

Business Street Address (DO NOT USE P.O. BOX) |

City |

County |

State |

Zip Code + 4 |

|

Business Telephone Number |

Business Fax Number |

Business Email |

|

|

2. |

Date of First Operation (mm/dd/yyyy): |

|

3. |

List months of operation if business is seasonal (mm-mm): |

|

4. |

List Business's Fiscal Year End: |

|

5. |

Identify Accounting Method: □Accrual |

□Cash |

|

I Section 4 Business Mailing Address (if different from Section 3 above)

If you want to have GADOR notices and other correspondence for a specific tax type mailed to an address other than the above business street address, please complete the following information. Use Form CRF-003 to list additional addresses.

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

Salesand Use | [Withholding □Amusement [ | Alcohol | |Tobacco | [Motor Fuel Distributor | |911 Prepaid Wireless

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

[ [Sales and Use I [Withholding I [Amusement | | Alcohol | | Tobacco | | Motor Fuel Distributor 911 Prepaid Wireless

Section 5 |

Business Ownership/Relationship |

|

|

|

| |

1. Name |

|

|

|

Social Security Number/Taxpayer Identification Number |

Mailing Address |

|

|

City |

|

County |

State |

Zip Code + 4 |

Check one: |

|

|

|

|

|

|

|

Owner |

|

LLC Member |

Partner |

Officer |

Other |

Effective Date: |

|

Check any/all if applicable: |

|

|

|

|

|

Alcohol Licensee |

Effective Date: |

|

|

Tobacco Licensee |

Effective Date : |

|

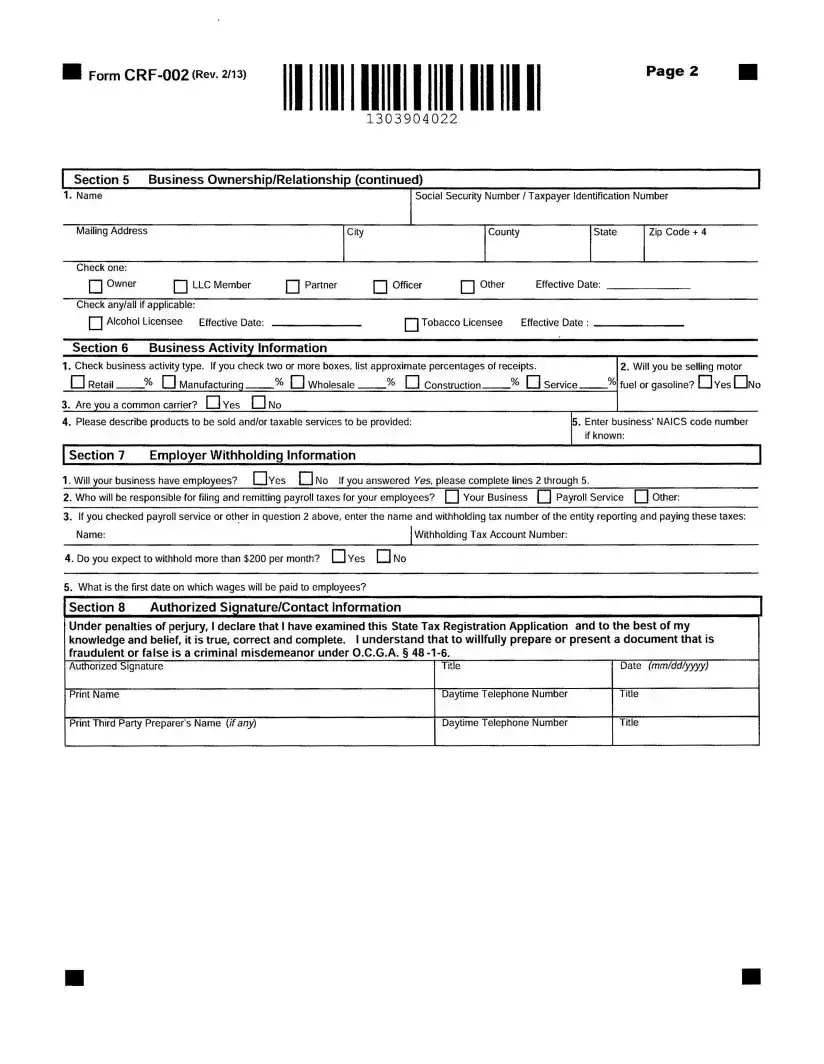

■ Form CRF-002 (Rev. 2/13) |

1303904022 |

Page 2 |

■ |

1303904022

| |

Section 5 |

|

Business Ownership/Relationship (continued) |

|

|

|

|

| |

1. |

Name |

|

|

|

|

|

|

Social Security Number/Taxpayer Identification Number |

|

Mailing Address |

|

|

|

City |

|

|

County |

|

State |

Zip Code + 4 |

|

Check one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

I |

I LLC Member |

| |

| Partner |

| | Officer |

| | Other |

|

Effective Date: |

|

|

Check any/all if applicable: |

|

|

|

|

|

|

|

|

|

|

I I Alcohol Licensee |

Effective Date: |

|

|

| |

| Tobacco Licensee |

|

Effective Date : |

|

|

Section 6 |

|

Business Activity Information |

|

|

|

|

|

|

|

1. Check business activity type. If you check two or more boxes, list approximate percentages of receipts. |

|

2. Will you be selling motor |

1 |

1 Retail |

% П Manufacturing |

% 1 |

1 Wholesale |

% 1 |

1 |

Construction |

% П Service |

% fuel or gasoline? CH Yes CHNo |

3. Are you a common carrier? П Yes П No |

|

|

|

|

|

|

|

|

4. |

Please describe products to be sold and/or taxable services to be provided: |

|

|

|

5. Enter business' NAICS code number |

|

|

|

|

|

|

|

|

|

|

|

|

if known: |

Section 7 |

|

Employer Withholding Information |

|

|

|

|

|

|

| |

1. Will your business have employees? □Yes Д No If you answered Yes, please complete lines 2 through 5.

2. Who will be responsible for filing and remitting payroll taxes for your employees? |

Your Business | | Payroll Service | | Other: |

3.If you checked payroll service or other in question 2 above, enter the name and withholding tax number of the entity reporting and paying these taxes: Name:_______________________________________________________ [withholding Tax Account Number:

4. Do you expect to withhold more than $200 per month? |

Yes EH No |

5.What is the first date on which wages will be paid to employees?

Section 8 |

Authorized Signature/Contact Information |

| |

Under penalties of perjury, 1 declare that 1 have examined this State Tax Registration Application and to the best of my knowledge and belief, it is true, correct and complete. 1 understand that to willfully prepare or present a document that is fraudulent or false is a criminal misdemeanor under O.C.G.A. § 48 -1-6.

Authorized Signature |

Title |

Date (mm/dd/yyyy) |

Print Name |

Daytime Telephone Number |

Title |

Print Third Party Preparer's Name {if any) |

Daytime Telephone Number |

Title |

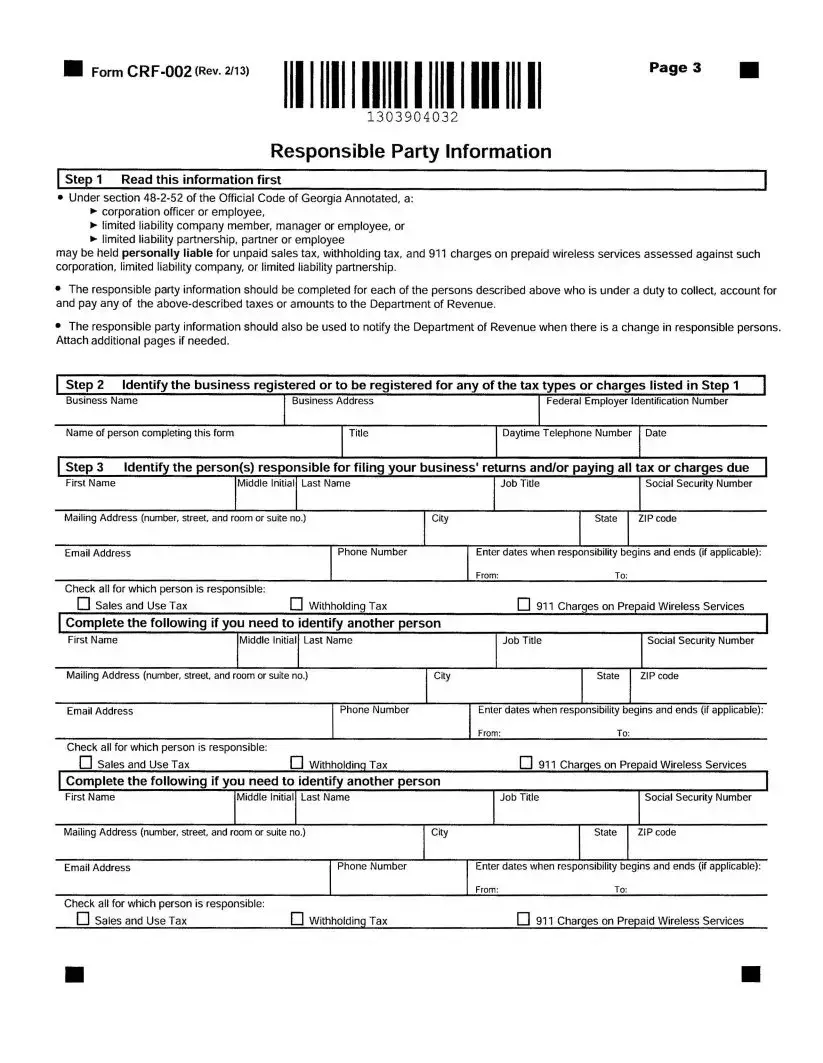

И Form CRF-002 (Rev. 2/13) |

1303904032 |

Page 3 |

1303 904032

Responsible Party Information

Step 1 Read this information first |

| |

•Under section 48-2-52 of the Official Code of Georgia Annotated, a:

►corporation officer or employee,

►limited liability company member, manager or employee, or

►limited liability partnership, partner or employee

may be held personally liable for unpaid sales tax, withholding tax, and 911 charges on prepaid wireless services assessed against such corporation, limited liability company, or limited liability partnership.

•The responsible party information should be completed for each of the persons described above who is under a duty to collect, account for and pay any of the above-described taxes or amounts to the Department of Revenue.

•The responsible party information should also be used to notify the Department of Revenue when there is a change in responsible persons. Attach additional pages if needed.

Check all for which person is responsible: |

|

|

□ Sales and Use Tax |

Д Withholding Tax |

□ 911 Charges on Prepaid Wireless Services |