Fill a Valid St 12B Georgia Template

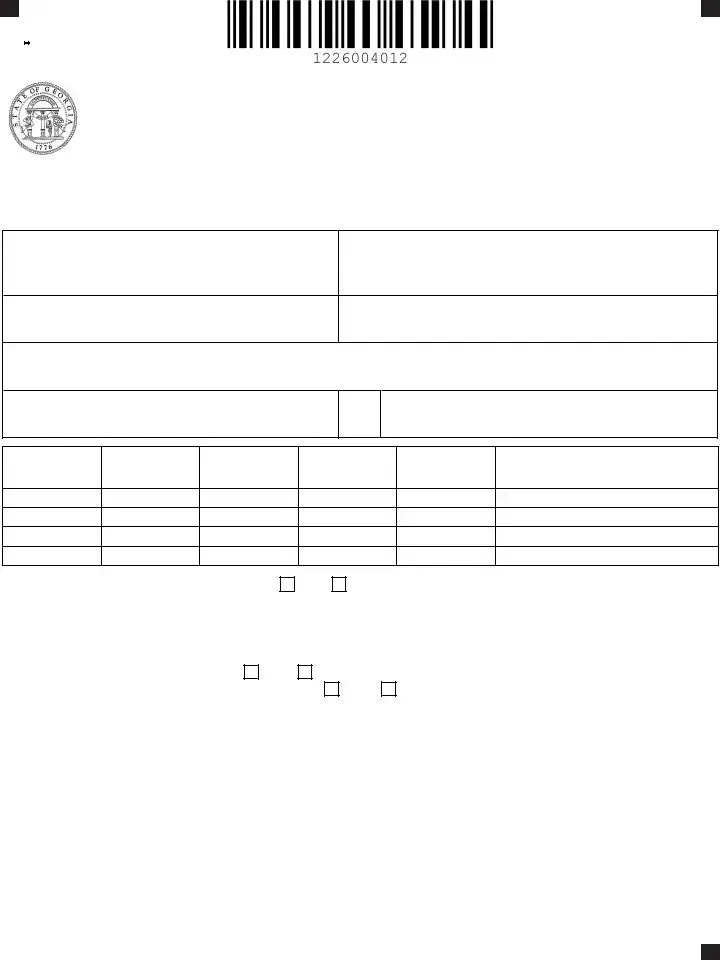

The ST-12B Georgia form serves as a vital tool for individuals seeking a refund of sales tax paid on purchases. This affidavit, designed for the purchaser's claim, requires detailed information about the transaction and the dealer involved. Understanding its components and requirements can significantly streamline the refund process for taxpayers in Georgia.

Get Form Here

Fill a Valid St 12B Georgia Template

Get Form Here

Get Form Here

or

Download St 12B Georgia

Finish your form in minutes

Finish St 12B Georgia online — fast edits, instant download.

NOTARY PUBLIC

NOTARY PUBLIC